APRs on personal loans will vary extensively from 1 lender to a different. The fascination level on your determines the amount of you can expect to finally repay. Even a relatively compact variation during the desire fee can increase 1000s of dollars more than the existence of your loan.

Since the lender is aware of it may recoup a number of its losses through repossession, it doesn’t Verify your credit score or have stringent requirements.

Our editors are devoted to bringing you impartial rankings and information. Our editorial articles is not really influenced by advertisers.

Character—may well consist of credit score record and reviews to showcase the background of the borrower's skill to fulfill debt obligations previously, their work experience and revenue degree, and any superb legal considerations

Not all companies allow paycheck developments, but you will find mobile paycheck advance applications which will help you borrow funds sans credit score Test. After you get your upcoming paycheck, the quantity you borrowed is going to be deducted from your account, usually with no charges or fascination.

Other components, for instance our very own proprietary website regulations and regardless of whether a product is obtainable in your town or at your self-picked credit rating variety, might also impact how and the place products look on This website. While we try to deliver an array of offers, Bankrate will not include things like details about each individual fiscal or credit goods and services.

In the home finance loan application course of action, the lender will purchase an appraisal of the home. They need to make certain its benefit exceeds the amount of the property finance loan loan.

Loan particulars—More time repayment terms can enhance the interest level as it is riskier for lenders. Additionally, building too very low a deposit (and that is also noticed as dangerous) can lead to the borrower obtaining a better curiosity price.

Money—refers to any other assets borrowers could possibly have, Except for cash flow, that could be utilised to fulfill a financial debt obligation, like a down payment, personal savings, or investments

Usually read more do not submit an application for credit rating also frequently—A lot of inquiries on the credit score report notify a lender that a borrower may have hassle attaining credit rating, which is an indication of the significant-threat borrower. An individual inquiry can deduct some factors off a credit score!

Up coming, evaluation the lender time period sheets close to one another to determine which loan will set you back significantly less eventually. Besides the APR, concentrate to closing expenses, origination service fees, pay as you go interests, and other charges that will have an impact on your regular monthly payment and the total Price of your property finance loan.

Samples of other loans that aren't amortized include curiosity-only loans and balloon loans. The former consists of an interest-only period of payment, and also the latter has a big principal payment at loan maturity.

Upstart has crystal clear eligibility specifications. You could possibly qualify with a credit score rating of 300, and it may well approve applicants with no credit in the least. Upstart also has the next requirements:

Jordan Tarver has used 7 years covering mortgage, personal loan and enterprise loan articles for top economical publications like Forbes Advisor. He blends awareness from his bachelor's diploma in small business finance, his knowledge as being a prime performer in the property finance loan sector and his entrepreneurial achievement to simplify intricate financial subjects. Jordan aims to create mortgages and loans easy to understand.

Spencer Elden Then & Now!

Spencer Elden Then & Now! Bradley Pierce Then & Now!

Bradley Pierce Then & Now! Keshia Knight Pulliam Then & Now!

Keshia Knight Pulliam Then & Now! Seth Green Then & Now!

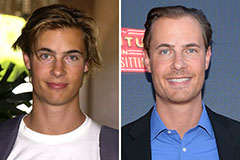

Seth Green Then & Now! Erik von Detten Then & Now!

Erik von Detten Then & Now!